Ofgem energy price cap forecast to fall by 14% in April; UK inflation dips to 3.9% – business live | Business

UK typical energy bill expected to fall to £1,660 by April

The UK’s energy price cap is predicted to fall by 14% in April, lowering household bills further.

A typical duel fuel consumer is expected to pay £1,660 a year, down £268 from January bills of £1,928, according to forecasters Cornwall Insight.

Bills expected to drop further, £1,590 in July before a slight increase to £1,640 from October.

Cornwall Insight explains:

Since mid-November, wholesale energy prices have experienced a significant decline, triggering the anticipated drop in the price cap. Contrary to initial concerns, the Israel-Hamas conflict and problems such as potential LNG (liquefied natural gas) production strikes in Australia have as yet failed to materially impact energy supplies.

Additionally, the absence of further pipeline disruptions, similar to the Finnish Balticconnector rupture, further bolstered confidence in energy security. These factors, coupled with a relatively mild winter to date, have left European gas-in-store levels above expectations for the remainder of winter. This situation has helped to drive down wholesale prices, as seen in the current forecasts of the price cap.

While forecasts have improved for now, global events such as the pandemic, the Russian invasion of Ukraine, and the conflict in Gaza have highlighted the susceptibility of UK energy prices to external factors. Prices may therefore rebound if future incidents, such as the disruption to shipping through the Red Sea, raise concerns over disruption to supplies.

Key events

Back to UK inflation, our main story.

Torsten Bell, chief executive of the think tank Resolution Foundation, tweeted:

Campaigners against new Sizewell nuclear plant lose appeal

Campaigners opposed to the building of a new nuclear power plant near Sizewell in Suffolk have lost the latest stage of a legal battle with the government.

The protest group, called Together Against Sizewell C, objects to a decision, made in 2022 by then business secretary Kwasi Kwarteng, to give the development the go-ahead. The group launched a Court of Appeal challenge after losing a High Court fight earlier this year. But three appeal judges dismissed the group’s appeal today.

Sir Keith Lindblom, Lady Justice Andrews and Lord Justice Lewis had considered arguments at a Court of Appeal hearing in London in November.

Lawyers representing the group told judges the central issue relates to whether a “development consent order” was lawful “without any assessment” of the environmental impacts of an “essential” fresh water supply.

The group had taken legal action against the energy security and net zero secretary Claire Coutinho and Sizewell C Ltd. Lawyers representing the two defendants said the appeal should be dismissed.

The government argued that it had made “legitimate planning judgments”.

A High Court judge, Mr Justice Holgate, had dismissed Together Against Sizewell C’s challenge. The three appeal judges said, in a written ruling published online, that Mr Justice Holgate had not “erred” in ruling against Together Against Sizewell C.

French energy giant EDF, which is due to develop the plant, has said Sizewell C is expected to generate low-carbon electricity to supply six million homes. Ministers say the multi-billion-pound project will create 10,000 highly-skilled jobs, and has been welcomed by unions and the nuclear industry.

Mike Ashley’s Frasers buys Matches for £52m

Sarah Butler

Mike Ashley’s Frasers Group has bought luxury fashion site Matches for £52m in its latest step into online retail.

The group, which owns the House of Fraser department stores and luxury streetwear chain Flannels, has bought Matches from private equity group Apax Partners which acquired a majority stake in the group in 2017 in a deal that valued the online retailer at £800m.

Founders Tom and Ruth Chapman, who founded the chain with one store in Wimbledon more than 30 years ago, cashed out about £400m from that deal but online fashion retail and the luxury sector have both struggled since the pandemic as hopes of a permanent switch towards buying from home more frequently have died away.

Michael Murray, the chief executive of Frasers who recently warned of a slowdown in the luxury market, said:

Matches has always been a leader in online luxury retail and has incredible relationships with its brand partners. This acquisition will strengthen Frasers’ luxury offering, further deepening our relationships and accelerating our mission to provide consumers with access to the world’s best brands. Whilst the global luxury environment is softer, we are confident that, by leveraging our industry-leading ecosystem, we will unlock synergies and drive profitable growth for Matches.

Matches chief executive, the former Asos boss Nick Beighton, said:

Being part of Frasers, with their utter commitment to luxury, will give this business access to greater scale, best-in-class retail expertise and the financial stability it needs to more effectively deliver for our brand partners and our customers.

E-scooter pioneer Bird Global files for bankruptcy

Bird Global, the company that pioneered on-street electric scooter rentals, has filed for Chapter 11 bankruptcy protection in Florida.

This comes five years after it became the first start-up ever to reach a “unicorn” valuation of more than $1bn.

The bankruptcy filing will enable the company to carry out a restructuring, and it said that it would operate as normal during that process. Its lenders have entered into a “stalking horse” sale agreement.

Bird hopes to complete a sale within 120 days. Its European and Canadian businesses are not part of the bankruptcy filing.

In September, the New York Stock Exchange suspended trading in Bird, after its market value fell below a $15m threshold.

The company’s interim chief executive Michael Washinushi said:

We are making progress towards profitability and aim to accelerate that progress by right-sizing our capital structure through this restructuring.

UK house prices fall most since 2011, says ONS

House prices fell by 1.2% across the UK in the 12 months to October, the biggest annual fall since October 2011, as the housing market felt the hit from higher borrowing costs.

House prices in London dropped the most, down by 3.6% from October 2022, according to the Office for National Statistics.

However, rents continued to rise, driven by a surge in demand from tenants, and a shortage of rental properties on the market.

The ONS’s gauge of private rents rose by 6.2% in the 12 months to November, the biggest annual increase since data collection started in 2016, and up from 6.1% in the 12 months to October.

UK typical energy bill expected to fall to £1,660 by April

The UK’s energy price cap is predicted to fall by 14% in April, lowering household bills further.

A typical duel fuel consumer is expected to pay £1,660 a year, down £268 from January bills of £1,928, according to forecasters Cornwall Insight.

Bills expected to drop further, £1,590 in July before a slight increase to £1,640 from October.

Cornwall Insight explains:

Since mid-November, wholesale energy prices have experienced a significant decline, triggering the anticipated drop in the price cap. Contrary to initial concerns, the Israel-Hamas conflict and problems such as potential LNG (liquefied natural gas) production strikes in Australia have as yet failed to materially impact energy supplies.

Additionally, the absence of further pipeline disruptions, similar to the Finnish Balticconnector rupture, further bolstered confidence in energy security. These factors, coupled with a relatively mild winter to date, have left European gas-in-store levels above expectations for the remainder of winter. This situation has helped to drive down wholesale prices, as seen in the current forecasts of the price cap.

While forecasts have improved for now, global events such as the pandemic, the Russian invasion of Ukraine, and the conflict in Gaza have highlighted the susceptibility of UK energy prices to external factors. Prices may therefore rebound if future incidents, such as the disruption to shipping through the Red Sea, raise concerns over disruption to supplies.

The fall in petrol prices in the UK may be short-lived, if oil prices continue to rise. Attacks by Yemen’s rebel Houthis on ships in the Red Sea have triggered fears that oil shipping could be disrupted.

Brent crude is up 1.2% today to $80.21 a barrel while US crude has risen 1.4% to $74.96 a barrel.

End of era as Toshiba delists from Tokyo stock exchange after 74 years

Toshiba, the Japanese company synonymous with the country’s 20th-century dominance of electronics, has delisted from the Tokyo stock exchange after 74 years.

The manufacturer, associated in the UK with its 1980s “Ello Tosh, gotta Toshiba” advertising campaign, was taken private on Wednesday in an £11bn deal by a consortium of investors led by the private equity investor Japan Industrial Partners (JIP).

The financial services firm Orix, the utilities provider Chubu Electric Power and the chipmaker Rohm are also part of the group.

It follows years of activist investor pressure on the company from foreign investors after turmoil started by an enormous accounting scandal that shook one of Japan’s best-known companies and raised questions about the country’s insular corporate governance model.

Toshiba has already taken steps to try to revive itself under the new ownership, including a deal with the investor Rohm to manufacture chips to control power supply to electronics. Some analysts believe the company may be broken up to try to realise more value.

Toshiba traces its roots back to a factory set up in 1875, according to a company history, less than a decade after the end of 250 years of Japanese cultural and economic isolation. The successor Shibaura Engineering Works merged with the Tokyo Electric Company in 1939 and was renamed Toshiba in 1978.

After surviving the turmoil of the second world war, Toshiba’s star rose along with the Japanese economy, which became the world’s second biggest after the US.

Workers at Tory donor’s JCB factory test positive for drugs after sniffer dogs called in

Anna Isaac

JCB, one of the UK’s biggest manufacturers, is investigating a spate of drug use among workers based at its headquarters and has sacked a “significant” number of staff, the Guardian can reveal.

A message sent to UK employees last week by the digger-maker’s group human resources director, Max Jeffery, seen by the Guardian, said it had been conducting a “series of investigations into substance misuse” over the past two months. This had resulted in a “small but significant number of people leaving JCB”.

The message, entitled “Substance Misuse and Workplace Safety”, said investigations continued.

Sniffer dogs have been used by private security at turnstiles at its Staffordshire headquarters, on production lines and in offices at the site last week.

Here’s our analysis on the UK inflation slowdown.

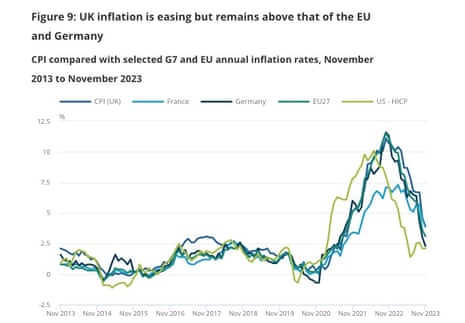

At last, UK inflation has fallen far and fast enough to start to match countries such as France, where the annual rate of price rises has reduced at a faster pace this year.

At 3.9% last month, the headline figure remains almost double the 2% target set for the Bank of England but significantly lower than the 11.1% peak in October last year and below the 5.3% target Rishi Sunak set for the end of 2023.

Even better, many prices dropped month on month. On the supermarket shelves, white and wholemeal sliced loaves and packs of cakes all fell between October and November after a rise in the same period a year ago.

However, as unions, thinktanks and the Labour party among others have pointed out, the cost of living crisis of the past two years is still being felt keenly by many. Food prices were 29% higher last month than they were in September 2021, and energy prices were 66% higher.

And our full story:

Julia Hoggett, chief executive and head of digital & securities markets at the London Stock Exchange, who previously worked at the FCA, responded to the proposed changes:

Listing rules are a critical component of a healthy and effective capital market. The FCA is now taking clear and decisive steps to ensure that our listing rules will be fit for the needs of existing companies, the next generation of high growth companies this country produces and the investors seeking to support them as they scale.

Updating the listing rules is only one part of the UK capital market reform agenda, but it is essential to levelling the playing field for UK listed companies when they compete with international peers and therefore critical to the competitiveness of our market and most importantly our economy.

We welcome the extensive engagement undertaken by the FCA on this core piece of reform and we look forward to engaging further with stakeholders on this agenda in the months ahead.

UK markets watchdog to shake up London listings

Away from the inflation data, Britain’s markets watchdog has proposed a single entry point to simplify and speed up company listings, in the biggest shake-up in three decades to help London compete with New York as well as EU centres in the wake of Brexit.

Britain accounted for only 5% of initial public offerings (IPOs) globally between 2015 and 2020, with the number of listings down by 40% from a peak in 2008. For example, the government failed to persuade UK chip designer Arm to list in London rather than New York.

As expected, the Financial Conduct Authority (FCA) said it proposes merging the “premium” listing on the London Stock Exchange, which has tougher rules, with the less onerous standard listing to meet one set of criteria under the banner of a “commercial” company listing.

It largely mirrors a discussion paper from last year that triggered some concern about a return to light-touch regulation.

Sarah Pritchard, FCA executive director for markets and international, said:

We are working to strengthen the attractiveness of UK capital markets and supporting UK competitiveness and growth.

The watchdog wants to rely more on disclosures by companies, rather than specific rules, thereby transferring more of the risk from an IPO to investors.

Companies would disclose any proposed significant corporate transaction, rather than the current mandatory vote of shareholders, which can be time-consuming in a fast-moving competitive bid. However, shareholder approval of a reverse takeover or a de-listing would remain, and there would need to be written relationship agreements with controlling shareholders.

Britain is keen to shake up listings and other financial rules to boost growth at a time when private money is needed to help the country invest to meet net-zero carbon targets.

Britain’s financial services minister Bim Afolami said:

The UK is Europe’s leading hub for investment but it’s a competitive world and we are by no means complacent.

The EU is already approving a law to help attract more listings on the bloc’s stock markets.

The FCA has cautioned that easing rules must be accompanied by a change in investor understanding and attitude towards risk. It said

The proposals could entail an increased possibility of failures, but the changes set out would better reflect the risk appetite the economy needs to achieve growth.

UK Finance, a banking industry body, said the proposals strike the right balance between managing risk and encouraging growth that will help attract more listings.

The 400 pages of proposals are being put out to public consultation until March, and final rules will come into effect in the second half of next year.

Our Money editor Hilary Osborne tweeted:

Great that inflation has fallen. It’s still in double digits for breakfast cereals (tell me about it), yoghurt, eggs, oils (olive oil has climbed to 54%), frozen veg and jams amongst other popular shopping basket items

— Hilary Osborne (@hilaryosborne) December 20, 2023

Markets price in first rate cut as soon as March

Financial markets are now fully pricing in the first interest rate cut from the Bank of England by May, possibly as soon as March, after UK inflation slowed more than expected to an annual rate of 3.9%, the lowest in two years. Lower petrol, bread and cake prices were the main drivers.

Interest rates are expected to be cut several times next year to below 4% by December, from 5.25% now.

Previously, markets were expecting borrowing costs to fall to 4% by the end of the year, so are now pencilling in a further quarter-point cut.

The FTSE 100 index has hit a three-month high, as investors cheered the surprisingly large drop in inflation.

The FTSE 100 jumped 1.3% to 7,738.

The pound dropped 0.6% below $1.27, as reported earlier.

Meanwhile, James Smith, developed markets economist at ING, said:

UK inflation has come in much lower than expected for November and markets are now pricing a whopping 140bp of cuts next year. That’s maybe pushing it, but investors are right to be thinking about several cuts next year, despite the Bank of England’s recent pushback.

Interestingly, this data has also seen investors reassess where the BoE stands relative to the Fed and European Central Bank. Up until now, markets had been expecting both of the latter to be much more aggressive than the BoE, but that narrative seems to be fading.

One thing we’ve often heard recently is that UK inflation (specifically services) is stickier and therefore that implies slower/later rate cuts relative to the eurozone. We wrote in more detail recently why a lot of the divergence in UK services inflation relative to the continent can be explained by factors not intrinsically linked to economic conditions. In the areas that really count for monetary policy – things like hospitality – the differences are much less dramatic.

So while the BoE might be a little later to the cutting game than other European economies, we don’t expect the UK to be an outlier when it comes to the extent of policy easing.

Opinion is divided on what the data means for UK interest rates.

Yael Selfin, chief economist at KPMG UK, said:

Today’s data will bolster the Bank of England’s argument that it remains too early to consider cutting interest rates, particularly with core inflation significantly above levels consistent with the inflation target.

The core inflation rate dipped to 5.1%, far above the central bank’s 2% inflation target.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, said:

CPI has taken a tumble hitting 3.9% in November. This is the lowest it’s been in more than two years and a bigger drop than expected. After years of unrelenting pressure on our budgets such a fall will be greeted with real relief.

The price of fuel was a major contributor to the drop as prices of petrol and diesel fell back. Food too was a major factor – fuelled by falls in bread and cereals where prices dropped 0.8% on the month, compared with a rise of 1.9% a year ago. The price of meat, milk, cheese and eggs also eased though it’s worth saying that food prices still remain high by historical standards.

Looking more widely this news has bigger implications for our finances. Such a drop could be taken as a sign that the Bank of England has gone as far as it needs to in its interest rate hiking cycle. Keeping the pause button pressed will be welcome news for those on variable rate mortgages who have seen their costs rise as well as those with credit card debt. Fixed rate mortgages could fall slightly, as the prospect of further rate rises fades but we’re not expecting any big moves until the market starts to expect a rate cut – which could be some time off yet.

It’s a welcome fall but it’s worth saying inflation remains higher than other countries such as Germany and well above the Bank’s 2% target. Things can also change rapidly – if we see fuel prices spike again or a strong growth in wages, then we could still see a rate rise. Similarly, if the economy looks to be weakening, we could see a rate cut materialise sooner than we think.

Shadow chancellor Rachel Reeves said:

The fall in inflation will come as a relief to families. However, after 13 years of economic failure under the Conservatives, working people are still worse off.

Prices are still going up in the shops, household bills are rising, and more than a million people face higher mortgage payments next year after the Conservatives crashed the economy.

Jeremy Hunt: ‘There’s still further to go’ on tackling inflation

The UK chancellor, Jeremy Hunt, said there was “still further to go” on tackling inflation, after the surprisingly large fall to 3.9% in November.

He told reporters:

There’s still further to go. Inflation never falls in a straight line.

In a statement, he explained:

With inflation more than halved we are starting to remove inflationary pressures from the economy. Alongside the business tax cuts announced in the autumn statement this means we are back on the path to healthy, sustainable growth.

But many families are still struggling with high prices so we will continue to prioritise measures that help with cost of living pressures.