UK dealmaking shrinks in 2023, but economy predicted to ‘turn corner’ in 2024 – business live | Business

UK M&A falls to lowest levels since financial crisis

2023 has been a poor year for dealmaking, particularly in the City of London.

The value of merger and acquisition activity with any UK involvement shrank by 33% this year to $265.4bn, new data from LSEG Deals Intelligence shows.

That’s the lowest year-to-date total since 2009.

LSEG Deals Intelligence reports that $120.2bn of M&A involving UK targets was conducted this year, a 45% year-on-year drop. The largest was the $6.1bn takeover for Dechra Pharmaceuticals, the UK veterinary pharmaceuticals company, by Swedish buyout group EQT.

Lucille Jones, senior manager at LSEG Deals Intelligence, says:

Steeply rising interest rates and a concerning outlook for the UK economy, combined with stricter antitrust enforcement and ongoing geopolitical tensions curbed the appetite for deal making in 2023.

M&A involving UK companies declined 33% to the lowest level in fourteen years, with double-digit percentage declines for both the domestic and cross-border deal categories, and across all sectors.

On a positive note, the year ended more strongly than it began, and with inflation coming down and rates normalizing, it could give CEOs and boards a little more confidence with which to plan their moves in 2024.”

Private equity firms launched $41.4bn worth of deals targeting UK companies during the year, a drop of 41% on the $70.5bn in 2022. But the number of deal announcements from PE firms – 915 – reached the highest level since records began in 1980.

Global dealmaking also cooled this year, with fewer than $3trn of deals secured in 2023.

Key events

Signa unit that co-owns Selfridges files for insolvency

Back in Europe, two key divisions of property company Signa are filing for insolvency, a significant development in the unravelling of founder Rene Benko’s real estate empire.

Signa Prime Selection filed for self-administrated restructuring in a Vienna court today, and Signa Development Selection will file tomorrow, Signa said.

It explained:

“It is well known that external factors have had a negative impact on business development in the real estate sector in recent months.”

The announcements are the latest twist in the saga for Signa, the biggest casualty so far in Europe’s real-estate crisis, which has been hit by rising borrowing costs and falling property valuations.

Signa Prime Selection holds many of the group’s high-end property investments, and is a co-owner of the Selfridges department store.

Parent company Signa declared insolvency in late November, after the property and retail giant failed in a last-ditch attempt to secure fresh funding.

Last month, Thailand’s largest department store owner, Central Group, has announced it has taken control of Selfridges department stores.

Central Group and Signa Group bought Selfridges in 2021 in a deal worth $5bn.

Over in New York, the main Wall Street share indexes have opened slightly higher.

On the penultimate trading day of 2023, the benchmark S&P 500 has gained 4.86 points or 0.1% to 4,786.44 points, nearly an alltime high.

The Dow Jones Industrial Average crept up by 0.01%, or 5 points, to 37,661.52, while the tech-focused Nasdaq Composite is 0.28% higher.

All three indices have had a strong year, lifted by hopes of US interest rate cuts in 2024.

US jobless claims rise

Just in: The number of Americans filing new claims for unemployment support has risen.

There were 218,000 fresh ‘initial claims’ for jobless support last week (the seven days to December 23), the US department of labor has reported.

That’s an increase of 12,000 on the previous week, but it still a low level in historic terms.

Economists had expected a smaller increase, to 210,000.

The four-week moving average of initial claims – a gauge of the health of America’s jobs market – has dropped by 250, to 212,000.

Over in the eurozone, a central bank policymaker has been pushing back against market expectations of rate cuts next year.

European Central Bank Governing Council member Robert Holzmann said it is too early to talk about lowering borrowing costs.

Holzmann argued that such a move in 2024 is anything but certain, saying:

“Even if the ECB is past an unprecedented series of ten consecutive rate increases, there is also for the year 2024 no guarantee of rate reductions.

“Monetary policy normalization is already showing its impact on slowing inflation, but it would still be premature to think about rate cuts.

Post Office cash withdrawals hit all-time high on last Friday before Christmas

Mark Sweney

More than £62m in cash was withdrawn from Post Office branches on the Friday before Christmas, the most ever in a single day, as people rushed to finish their festive shopping.

The record withdrawals on 22 December from the 11,500 Post Office branches across the UK beat the previous record of just over £51m, set on the final Friday before Christmas last year.

The record also reflects the sharp increase in the cost of living over the past two years as the rate of inflation hit a 41-year high of 11.1% late last year, although it has since eased to 3.9% in November, the lowest rate of increase in two years.

“For some people, being able to withdraw cash for free helped them to finish last-minute shopping for the big day, for others it may have been a last-minute gift,” said Ross Borkett, head of banking at the Post Office.

More here:

UK M&A falls to lowest levels since financial crisis

2023 has been a poor year for dealmaking, particularly in the City of London.

The value of merger and acquisition activity with any UK involvement shrank by 33% this year to $265.4bn, new data from LSEG Deals Intelligence shows.

That’s the lowest year-to-date total since 2009.

LSEG Deals Intelligence reports that $120.2bn of M&A involving UK targets was conducted this year, a 45% year-on-year drop. The largest was the $6.1bn takeover for Dechra Pharmaceuticals, the UK veterinary pharmaceuticals company, by Swedish buyout group EQT.

Lucille Jones, senior manager at LSEG Deals Intelligence, says:

Steeply rising interest rates and a concerning outlook for the UK economy, combined with stricter antitrust enforcement and ongoing geopolitical tensions curbed the appetite for deal making in 2023.

M&A involving UK companies declined 33% to the lowest level in fourteen years, with double-digit percentage declines for both the domestic and cross-border deal categories, and across all sectors.

On a positive note, the year ended more strongly than it began, and with inflation coming down and rates normalizing, it could give CEOs and boards a little more confidence with which to plan their moves in 2024.”

Private equity firms launched $41.4bn worth of deals targeting UK companies during the year, a drop of 41% on the $70.5bn in 2022. But the number of deal announcements from PE firms – 915 – reached the highest level since records began in 1980.

Global dealmaking also cooled this year, with fewer than $3trn of deals secured in 2023.

Here’s Susannah Streeter, head of money and markets at Hargreaves Lansdown, on the dip in the oil price this morning (see previous post).

A barrel of Brent crude has edged below $80 pushing down energy giants, Shell and BP in early trade.

With Maersk now scheduling tankers resuming their passages via and Suez Canal and the Red Sea, thanks to the reassurance of a US-led maritime force in the region, it’s helped dispel some immediate concerns about supply issues.

However, tensions remain elevated, with Middle Easter leaders warning about the conflict widening, with Israel’s border with Lebanon, a worrisome hotspot, following attacks by Hezbollah. So, crude prices are staying largely elevated, especially with the US economy showing signs of resilience, boosting the outlook for global demand.’

In the energy market, oil prices have dipped as traders continue to ponder the risk of disruption to Red Sea shipping.

Brent crude, the international benchmark,has slipped back below $80 per barrel to $79.35/barrel.

Earlier this week it hit a four week high of $81.72, after Houthi militia claimed responsibility for a missile attack on a container ship in the Red Sea.

Yesterday Danish shipping giant Maersk said it was preparing to resume shipping operations through the Red Sea and Gulf of Aden, after the US rolled out an international military operation called Operation Prosperity Guardian to protect ships in the region.

But Germany’s Hapag-Lloyd has said it will continue to reroute vessels via the Cape of Good Hope at the south of Africa.

Oil prices steadied on Thursday after falling sharply in the previous session, as concerns eased about shipping disruptions along the Red Sea route even as tensions in the Middle East continued to rise. Brent crude futures inched up 10 cents. https://t.co/XGR1g4dyUI

— The Financial Express (@febdonline) December 28, 2023

India’s stock market hits record high

Indian shares have hit a record high this morning, as Asia-Pacific markets continue to rally as traders bet on interest rate cuts from major central banks next year.

India’s blue-chip NSE Nifty 50 index has gained 0.3% to hit 21,721.10 points, while the S&P BSE Sensex is up 0.31% at 72,264.17 points.

India’s stock market has gained over 18% this year, helped by solid growth in corporate earnings so far and a positive outlook over the next three years, analysts say.

UK government debt has hit a near nine-month high this morning, as City traders anticipate the Bank of England will cut interest rates in 2024.

Britain’s benchmark 10-year gilt yield briefly fell to its lowest level since April 6 this morning, dipping to 3.433% at the start of trading, Reuters reports.

Yields measure the rate of return on a bond, and fall when prices rise.

FT: Global defence orders surge as geopolitical tensions mount

2023 has been another busy year for the world’s major weapons makers, as geopolitical tensions have grown.

The Financial Times has calculated that the order books of the world’s biggest defence companies are near record highs after growing by more than 10% in just two years, partly due to the conflict in Ukraine.

They explain:

An analysis by the Financial Times of 15 defence groups, including the largest US contractors, Britain’s BAE Systems and South Korea’s Hanwha Aerospace, found that at the end of 2022 — the latest for which full-year data is available — their combined order backlogs were $777.6bn, up from $701.2bn two years earlier.

The trend’s momentum continued into 2023. In the first six months of this year — the latest comprehensive quarterly data available — combined backlogs at these companies stood at $764bn, swelling their future pipeline of work as governments kept placing orders.

European stock markets have opened higher.

In London, the FTSE 100 index has gained 20 points, or 0.25%, to 7744 points.

Mining stocks are leading the risers, with Rio Tinto up 1.2% and Anglo American gaining 1% (the weaker dollar has lifted commodity prices).

Germany’s DAX has gained 0.2% with France’s CAC 0.3% higher.

Bloomberg; UK economy set to escape hard landing in boost for Rishi Sunak

A survey of economists by Bloomberg, released this morning, predicts Britain’s economy will probably avoid a recession in 2024.

The poll of 52 economists found that the economy is expected to strengthen in the second half of next year as consumers benefit from falling inflation and the easing of a lengthy cost-of-living crisis.

Although the economy is only forecast to expand by 0.3% in 2024, the Treasury and the Bank of England are now expected to engineer a soft landing for the economy next year.

That would be a boost for Rishi Sunak as he considers when the next general election should be called.

However, we learned just before Christmas that the economy shrank in July-September, putting it on the brink of recession. Another contraction in October-December would mean a technical recession.

Bloomberg say:

Almost a third of the economists who submitted quarterly forecasts to the Bloomberg survey expect a contraction in the final three months of 2023. That would put the UK in recession under the common definition of two consecutive quarters of negative growth.

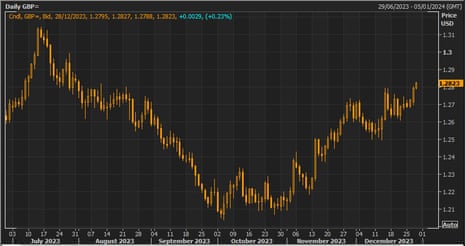

Pound jumps over $1.28

The pound has hit its highest level against the US dollar since the beginning of August, as investors continue to bet on falling US interest rates in 2024.

Sterling has climbed to $1.2825, its highest level in almost five months, as the dollar weakens in somewhat thin trading this morning.

Traders are anticipating that the US central bank, the Federal Reserve, will cut interest rates briskly in 2024, as inflation in America continues to cool.

Soft US economic data is helping to weaken the dollar.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, explains:

Released yesterday, the Richmond Manufacturing index came in much softer than expected – hinting at a significantly faster slowdown in economic activity in December, shipments also contracted significantly compared to a year ago.

US interest rates are currently a range of 5.25%-5.5%; and could fall to 3.5%-3.75% by December 2024, according to CME Fedwatch.

UK interest rates are also expected to fall next year, though, from 5.25% today to as low as 3.75% by next December, according to the latest money market pricing.

Introduction: UK economy to ‘turn a page’ in 2024

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

With just two trading days until the new year, thoughts in the City of London are turning to 2024. How fast will interest rates be cut? Will the UK avoid recession? When will the general election be, and who will win?

Accountancy group PwC has stirred the pot with their own economic outlook for the coming year. And it predicts a more rosy view on the economy next year, as the UK “turns a page from the difficult post-pandemic years”.

PwC points to several reasons for optimism – conditions for households are expected to improve, as the minimum wage is increased by almost 10% in the spring.

Inflation is tipped to fall faster than expected, close to the UK’s 2% target, which will help consumer sentiment to turn a corner.

And while growth is likely to be weak, the UK is expected to post a faster recovery compared to pre-pandemic levels than Germany, France or Japan.

PwC predicts:

The UK will be the fourth best performing G7 economy relative to pre-pandemic levels: Despite weak projected growth in 2024, the UK will still outperform France, Japan and Germany with real GDP around 2.7% higher in 2024 on average relative to 2019 levels.

BUT there’s bad news too. Even if inflation does cool, consumer prices will still be about a quarter higher than in early 2021.

Average rents in London are forecast to keep climbing, and will average more than £2,000 per month by the end of 2024 – around three times higher than in the north-east on average.

The rest of the UK will also see a continued rise in rents with an average increase of over 5% in 2024.

And PwC expects “a significant rise in corporate insolvencies in 2024”, with almost 30,000 firms expected to fail under the pressure of high interest rates, and increased costs.

Many will be smaller businesses, in sector such as hotels & catering, manufacturing, and transport & storage.

Barret Kupelian, chief economist at PwC, says the UK’s economic outlook is ‘far rosier’ than it appeared a year ago, although geopolitical tensions could change the picture…

“Following the post-pandemic challenges, 2024 will be the year the UK turns a page. Inflation returning closer to normal levels, progress on regional growth and real incomes improving provides optimism for the year ahead, despite the legacy of higher consumer prices and rising housing costs.

There remain many ‘known unknowns’ in 2024 that can change the trajectory of the UK, such as volatility in global energy prices due to the continued middle eastern conflict and the forthcoming General Election, however, overall the outlook is far rosier for 2024 than expected twelve months ago.