UK mortgage approvals hit six-month low; pandemic recovery faster than expected – business live | Business

UK mortgage approvals hit six-month low

Newsflash: UK mortgage approvals have fallen to their lowest level in six months, as high interest rates cool the housing market.

The Bank of England reports that net mortgage approvals for house purchases fell from 49,500 in July to 45,400 in August.

That’s the lowest number of home loans approved by lenders since February this year, and the latest sign that the 14 increases in UK interest rates since December 2021 have hit demand.

Net approvals for remortgaging (which only capture remortgaging with a different lender) saw “a significant decline” from 39,300 in July to 25,000 in August, the lowest since July 2012, the Bank says.

A report earlier this week showed that the number of first-time buyers in the UK has fallen by more than a fifth, as the jump in mortgage costs made it too expensive for some people to get onto the housing ladder.

Key events

Rishi Sunak’s optimism (see previous post) could be misplaced, if the economy stumbles in the months ahead.

The European economics team at Nomura, for example, fear that a recession could now be more likely.

Here’s their take on this morning’s upgrades to UK GDP:

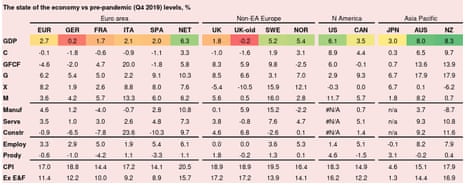

While that’s a substantial revision, there are plenty of reasons to be cautious in interpreting this news, including the fact that the revision was more limited relative to the scale of moves in GDP at the time, that it’s somewhat historical, that GDP is still underperforming other countries (like the US, Scandies, Australia and NZ, and even Japan – see table below), and that the inflationary (and thereby monetary policy) consequences of the revision might be limited, if one believes that both demand and supply potential have changed at the same time.

What will be more important going forward is whether the recession we expect materialises. Indeed, a recession might even be more likely following these revisions to the extent they suggest post-pandemic catch-up growth is now more complete. That should pull down on inflation and would support our view that the Bank of England is now done tightening policy. It would also support the idea of rate cuts beginning in 2024.

The PM posts:

People doubted the strength of the UK economy – today’s data proves them wrong.

We’re sticking to the plan to halve inflation and grow the economy.

You can trust me to get it done. https://t.co/ix2sse52v8

— Rishi Sunak (@RishiSunak) September 29, 2023

Bank of England urges lenders to take care on loan default risk

The Bank of England has urged UK lenders not to underestimate the risk of loan defaults as higher inflation and increased interest rates hit more vulnerable borrowers.

In a letter to chief financial officers at financial institutions supervised by the BoE, published online, the central bank also warned them not to overestimate how much money they would recover when borrowers defaulted on loans.

Victoria Saporta, the BoE’s executive director for prudential policy, wrote:

“We encourage further efforts by firms to challenge whether models capture risks associated with affordability, including the impact of higher inflation and interest rates on vulnerable borrowers or sectors.”

Saporta added that default experience has been limited in recent years, so firms need to examine if their post model adjustments (PMAs) are up to speed:

Given higher inflation and interest rates, we believe it is important to challenge recovery assumptions used in loss given default and compensate for model and data limitations through PMAs.

Severn Trent customer water bills to rise by almost 37% by end of decade

Mark Sweney

Severn Trent is to increase customers’ bills by almost 37% by the end of the decade and has raised £1bn in investment – half from Qatar’s sovereign wealth fund – to pay for a multibillion investment plan to improve its water network over the next five years.

The company, which has 4.2 million customers, said the average annual household bill would rise from £379 in 2024-25 to £518 in 2029-30.

It predicted that by 2030 the cost of a bill would be 1.3% of the disposable income of a typical household in the Severn Trent region, compared with 1.2% today, and attempted to soften the blow by announcing a £550m financial support package for struggling customers.

The company said:

“Severn Trent recognises that while this increase is spread over a long period, today’s announcement comes at a difficult time for some customers.

“That is why we have included a £550m financial support package as a core part of the plan. This will help 693,000 customers pay their bill each year by 2030.”

The company plans to invest a record £12.9bn on its network over the next five years, including £5bn on projects designed to tackle the water industry’s poor environmental record, which it said would create 7,000 jobs across the Midlands region. More here.

Energy bills ‘could hit almost £1,900 annually’ in January

Jillian Ambrose

Household energy bills could climb to an average of almost £1,900 a year in the coldest months of the year under the government’s energy price cap, according to a leading forecaster.

The energy price cap is expected to climb from an average of £1,834 a year set to take effect from October to just under £1,898 for the months from January to March, according to analysts at Cornwall Insight, in a blow to households hit by the cost of living crisis.

The energy price cap sets the maximum price that suppliers can charge based on the typical gas and electricity bill, meaning a cold winter could push bills higher if households need to keep the heating on for longer. The cap remains more than 50% higher than pre-pandemic levels.

More here:

The Office for National Statistics is pretty clear that its revisions to GDP data are not fixing ‘errors’ – but a natural feature of how national accounts are compiled.

In a blogpost today Craig McLaren, the head of national accounts at the ONS, says:

Collecting and publishing estimates for growth and many other areas of our society and economy were clearly challenging during a once-in-a-century pandemic, which fundamentally shifted all aspects of how our economy functioned.

The revisions performance for the UK economy in normal times compares well with the best in the world. So we are confident that moving forwards both our initial and later estimates for growth will remain a trusted data source for economic policymakers.

McLaren also points out that other statistical bodies have made similar reporting revisions:

Our estimates for growth increased by +1.1 percentage points for 2021, while Spain also increased its by +1.1 percentage points, the Netherlands by +1.3, and Italy also by +1.3.

A new blog from Craig McLaren looks at today’s latest GDP figures and puts them into the context of similar updates from other European countries https://t.co/eq58Sfl1c4

— Office for National Statistics (ONS) (@ONS) September 29, 2023

Another sign of a cooling UK housing market: the number of house sales fell by 16% in August compared with the same month a year earlier.

That’s according to provisional HM Revenue and Customs (HMRC) figures.

An estimated 87,010 home sales took place across the UK last month, which was 16% lower than in August 2022 but 1% higher than July 2023.

It was the weakest August for house sales since 2020, when the market was dealing with the impacts of the coronavirus pandemic.

Compared with last year, UK residential transactions in Aug 23 were 16% lower. Surprisingly though there was a mild uptake in both estimated seasonally (1%) & non -seasonally (11%) adj figures on July 23 pic.twitter.com/WKyhyY2k1I

— Emma Fildes (@emmafildes) September 29, 2023

Full story: UK economy makes stronger recovery from pandemic than first thought

Richard Partington

The UK economy made a faster recovery from the Covid pandemic than previously estimated, according to revisions to official figures revealing a stronger performance than Germany and France.

In a boost for Rishi Sunak before the Conservative party conference in Manchester beginning this weekend, revised figures from the Office for National Statistics (ONS) showed gross domestic product was 1.8% above pre-pandemic levels at the end of the second quarter this year.

In August, the ONS had estimated the economy was still 0.2% below the level at the end of 2019 before the global health emergency triggered one of the deepest recessions on record.

The changes mean the UK economy is no longer the worst performer in the G7. The chancellor, Jeremy Hunt, said:

“We know that the British economy recovered faster from the pandemic than anyone previously thought, and data out today once again proves the doubters wrong.”

More here:

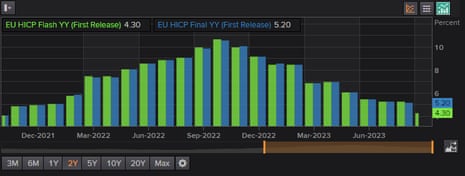

Eurozone inflation hits two-year low

Over in the eurozone, inflation has dropped to its lowest level in two years.

Consumer prices in the eurozone rose by 4.3% in the year to September, the flash estimate from statistics body Eurostat shows.

That’s a sharp fall on August, when prices rose by 5.2% per year, and the lowest reading for eurozone inflation since October 2021.

It was driven by a fall in energy prices, which were 4.7% lower this month than in September 2022.

But, food, alcohol & tobacco is expected to have the highest annual rate in September (8.8%, compared with 9.7% in August).

Services inflation slowed to 4.7% per year, down from 5.5% in August, while goods inflation dropped to 4.2%, from 4.7% per year in August.

This still leaves inflation over double the European Central Bank’s 2% target, but it’s a lot lower than a year ago (inflation was 9.9% a year earlier).

It could encourage the ECB to leave interest rates at their current (record) highs.

Diego Iscaro, head of European economics at S&P Global Market Intelligence, explains:

“The September “flash” estimate shows a larger than expected declines in both headline and core inflation. Base effects played a key role in explaining the sharp fall in inflation, but the figures also suggest that underlying inflationary pressures are becoming less intense.

Rising oil prices pose an upward risk to the immediate inflation outlook, but the expected slowdown in activity over the coming months should help to offset some of this impact.”

The figures reinforce the view that interest rates have likely reached their peak in the current tightening cycle. Excluding an acceleration in underlying inflationary dynamics over the coming months, the focus will now switch to the duration for which the current level of rates will be maintained. We currently expect the first cut in rates to materialise in June 2024.

Here’s Alice Haine, personal finance analyst at Bestinvest, on this morning’s UK mortgage figures:

“Mortgage approvals plunged 8% in August, as high mortgage rates caused major affordability challenges for buyers. Net approvals for remortgaging, which capture remortgaging with a different lender, also saw a significant decline as more homeowners stuck with their existing lender rather than switch to a new provider to avoid affordability checks.

While mortgage lending edged up for the fourth consecutive month, the decline in mortgage approvals – a forward-looking indicator – signalled that mortgage lending is likely to remain weak in the final months of this year as cost-of-living pressures and high borrowing costs make it harder for buyers to secure the homes they want. However, there is a hint of optimism in the air with estate agents reporting a rise in enquiries.

Wondering why lenders are trimming rates? Continued market uncertainty & affordability issues over the summer saw net mortgage approvals for house purchases fall 4,500 to 45,400, the lowest level in 6mths. @bankofengland pic.twitter.com/wb5AMKtlSY

— Emma Fildes (@emmafildes) September 29, 2023

The Bank of England’s latest mortgage data suggests further weakness ahead in the property sector, as higher interest rates continue to weigh heavily on lending.

Capital Economics explains:

The interest rate on newly drawn mortgages increased by another 16 basis points, from 4.66% to 4.82%.

And the further rise in average quoted mortgage rates to 5.7% in August, which takes a few months to feed through to actual mortgage rates, suggests more weakness in housing activity and prices lies ahead.

UK mortgage approvals hit six-month low

Newsflash: UK mortgage approvals have fallen to their lowest level in six months, as high interest rates cool the housing market.

The Bank of England reports that net mortgage approvals for house purchases fell from 49,500 in July to 45,400 in August.

That’s the lowest number of home loans approved by lenders since February this year, and the latest sign that the 14 increases in UK interest rates since December 2021 have hit demand.

Net approvals for remortgaging (which only capture remortgaging with a different lender) saw “a significant decline” from 39,300 in July to 25,000 in August, the lowest since July 2012, the Bank says.

A report earlier this week showed that the number of first-time buyers in the UK has fallen by more than a fifth, as the jump in mortgage costs made it too expensive for some people to get onto the housing ladder.

Estate agent Knight Frank have updated their forecast for UK house prices, and now expect a larger fall this year.

They say:

-

Knight Frank now expect UK house prices to fall by 7% this year, more than our forecast of -5% in March

-

Next year, Knight Frank expect prices to fall by 4%, less than the 5% we forecast earlier this year

-

Forecasts for prime central London remains unchanged, but expect a slightly smaller fall (-3% rather than -4%) this year in prime outer London and a marginally stronger recovery from 2026

Just in: UK average mortgage rates continue to drop, as lenders offer better deals amid hopes that the Bank of England has ended raising interest rates.

Data provider Moneyfacts reports that:

-

The average 2-year fixed residential mortgage rate today is 6.48%. This is down from an average rate of 6.50% on the previous working day.

-

The average 5-year fixed residential mortgage rate today is 5.98%. This is down from an average rate of 5.99% on the previous working day.

Today’s GDP data is full of interesting nuggets.

And one is that UK household disposable incomes grew faster than inflation in April-June, having stagnated in January-March due to fast-rising prices.

Real households’ disposable income (RHDI) grew by 1.2% in Quarter 2, the ONS reports.

Household savings also increased in the quarter, which suggests that spending did not rise in line with this pickup in RHDI.

Sandra Horsfield, economist at Investec, explains:

Meanwhile, data for Q2 GDP broken down by sector, published for the first time today in accordance with the typical release cycle, revealed that household disposable income growth exceeded inflation, meaning there was a 1.2% quarterly increase in real terms – not least thanks to the rise in benefit payments in line with past inflation.

Consumption growth did not keep pace with this rise, meaning the household saving ratio jumped from 7.9% in Q1 to 9.1% in Q2.

Stocks have opened higher in London, as the upgraded UK GDP data brings some cheer to the City.

The FTSE 100 index is 41 points higher (+0.5%) at 7643 points, taking its gains this month to +2.8% – outperforming Wall Street which is in the red for September.

Retail chain JD Sports (+5.8%) is leading the risers, followed by online grocery group Ocado (+4.2%) and specialty chemicals maker Croda (+2.6%).

Neil Wilson of Markets.com says a “messy” September is coming to an end, with the FTSE 100 benefiting from higher oil prices:

BP and Shell have rallied 10% through September as crude broke to its highest in a year this month.

Elsewhere the seasonal weakness of September asserted itself once more – the S&P 500 and Nasdaq slipping around 5%, whilst the DAX and broader European equities ex-UK are down about 3%.

The DAX has fallen about 4% in the quarter, but still +10% YTD, whilst the S&P 500 is roughly 3% lower in the quarter and +12% YTD. Bonds clearly blown up a bit this month and the dollar and oil have risen sharply once more. WTI +30% QTD is the best quarter since Q1 2022.