HSBC UK ‘working hard’ to fix online banking problem; Amazon workers begin Black Friday strike action – business live | Business

HSBC hit by mobile and online banking problems

HSBC UK customers hoping to take advantage of Black Friday have been hit by technical problems with their banking services.

HSBC says it is investigating the problems as “as a matter of urgency”, as customers report problems using its app or accessing online banking.

In a post on X (formerly Twitter), HSBC says:

We understand some customers are having trouble accessing banking services as usual right now.

“We’re investigating this as a matter of urgency and will share an update as soon as possible.”

We understand some customers are having trouble accessing banking services as usual right now.

We’re investigating this as a matter of urgency and will share an update as soon as possible.

— HSBC UK (@HSBC_UK) November 24, 2023

HSBC’s status page says “some customers are currently experiencing issues logging on to online and mobile banking”, adding that “We are working hard to fix this”.

The technical problems could make it harder for people to transfer money between accounts to pay bills, or to fund Black Friday spending.

Fantastic for a global bank with no branches because online is so good, it’s payday, bills are going out but I can’t transfer my wage to pay them. You gonna pay everyone’s overdraft and late payment charges?

— Trisha (@trishanna81) November 24, 2023

Key events

Times are tough at Big Four accountancy group KPMG.

The FT reports today that KPMG has frozen pay for around 12,000 employees in the UK, as demand for services across the firm slows. Bonuses are also be cut, as the slowdown i dealmaking this year hits revenues.

KPMG had previously frozen pay for its deal advisory staff, where 125 jobs were being cut, but it has now decided to prioritise pay rises for employees who are getting promoted. More here.

Back on Black Friday spending, lender Nationwide has reported that its customers had made 3.22 million transactions by noon today – which is 5% more than a year ago.

It’s also 14% more than a typical Friday.

Mark Nalder, director of payment strategy at Nationwide Building Society, explains:

“Many people have spent the morning looking for Black Friday discounts.

The number of purchases has been in line with what we predicted – up five per cent on last year and 14 per cent on what we see on a typical Friday. Historically the upcoming lunchtime period has been the peak time for spending as people search for bargains either online or on the high street during their break.”

Seperately, Barclays has reported that transations in the last week are higher than a year ago, as retailers continued to launch sales earlier in the month.

Barclays found that transactions in the last week were 1.4% higher than last year, and also 2.25% higher than a month ago.

Marc Pettican, head of Barclaycard Payments said:

“Over the last few years we’ve seen Black Friday sales arrive earlier and earlier, with shoppers spreading their spending over a longer period of time. Although the cost-of-living may be impacting some shoppers’ spending on non-essential items, many are still taking the opportunity to bag a Black Friday bargain. No doubt this will be welcome news to retailers who may have anticipated a slower November as shoppers’ budgets continue to be squeezed.

“It’s also encouraging to see that transaction volumes this week reflect a much busier shopping period than a regular week within the year, too. Retailers will undoubtedly hope that sales remain strong throughout today and over the weekend.”

It’s Madness at HMV reopening

Over on Oxford Street, classic British band Madness have shown up for the reopening of HMV’s store.

The historic Oxford Street outlet is opening again after a four year hiatus, after HMV fell into administration in 2019.

The retailer was rescued from insolvency by Canadian Doug Putman’s Sunrise Records business. Putman has said he hopes the shop can have “crowds which will shut down the street” again.

As well as Madness, other acts including the South African singer Baby Queen and the rock bands Hard-Fi and the Reytons were performing today.

Putman told the Guardian that HMV, which currently has more than 100 stores across the UK, had seen total sales rise this year, with sales of CDs up for the first time in more than a decade.

Putman said CDs had regained appeal because they were now relatively cheap and there was also a “doubling down on trying to buy everything (a band) comes out with”. Taylor Swift’s album reissues are selling across all formats, for example.

More here:

Advice for HSBC customers

Anyone caught up in the HSBC technical problems should keep a record of any extra costs they incur, says Sam Richardson, deputy editor of Which? Money.

Richardson explains:

“This HSBC outage will cause a real headache for a lot of its customers. In the worst cases it could prevent people making essential payments such as rent and bills, but it also falls on Black Friday, one of the busiest shopping days of the year, where many people will be looking to make significant savings on big-ticket items.

“We strongly advise customers that have been left out of pocket to keep evidence of extra expenses they may have incurred as a result of the outage, so they can be claimed back from HSBC.

“People want a bank they can depend on, and if IT outages become a regular occurrence, consumers could be tempted to vote with their feet and switch to an alternative provider – particularly with a lot of tempting switching incentives on offer at the moment.

“Having a back-up bank account or credit card can help, by giving consumers a way to make essential payments during outages like these.”

Today is turning into a bleak Friday for UK computer games developer Team17.

Older readers may remember Team17 from its rather fine 1990s classic Worms (in which your small group of worms, armed with guns, missiles, and bespoke kit like a holy hand grenade or exploding sheep, fought other wriggly platoons).

Anyway, things aren’t going so well this year.

Team17 told shareholders this morning that some titles are not meeting sales expectations, while it has been “too slow” to address some project overspends.

Overall, the company insists that it is well positioned, and expects revenues this year to be modestly ahead of current market expectations.

But investors have sent its shares down by over 40% today.

That’s a blow to founder Debbie Bestwick, who still owns a fifth of the company. Her stake has fallen by almost £40m today. Bestwick announced in March she would step down by the end of the year.

The problems at HSBC UK are understood to have been caused by an “internal systems issue”, says PA Media.

Boots sale could be revived as pension scheme is offloaded

Sarah Butler

Elsewhere in the UK this morning, Boots is paying £670m to offload its £4.8bn pension scheme to Legal & General.

The buy-in deal insures all 53,000 members in the Boots Pension Scheme, making it the largest single transaction of its kind ever in the UK, my colleague Sarah Butler explains.

To facilitate the deal, Boots will bring forward about £170m of already committed payments to the Scheme and has committed to pay extra contributions expected to be approximately £500 million.

The deal could help revive a process for the sale of Boots by its US owner Walgreens. An earlier sales plan was abandoned in June last year, and is thought to have been partly scotched by potential buyers’ concerns about Boots’ guarantees on the pension scheme that were thought to be worth billions of pounds.

John Ralfe, the independent pensions expert who once oversaw Boots’ pension scheme, said the buy-out deal was “good news for members” as there benefits would be unaffected and they were now supported by a “properly capitalised and regulated business.”

Credit rating agency S&P Global has weighed in on Jeremy Hunt’s autumn statement

They point out that the tax cuts announced by the chancellor will not held rebuild the UK’s diminished fiscal headroom (Hunt having spent most of a windfall from lower borrowing and expected higher tax receipts).

S&P Globl point out that the public finances will benefit if the UK economy does better than expected next year, but add:

“Stabilizing or reducing public debt levels will remain a key challenge.”

Full story: Thousands of HSBC customers in UK unable to access online banking services

Mark Sweney

Thousands of HSBC customers have reported that they have been unable to access its online and mobile banking services on one of the busiest online shopping days of the year as consumers swoop on Black Friday retail deals, my colleague Mark Sweney writes.

More here.

HSBC: We’re really sorry

HSBC UK has now said it is “really sorry” about the disruption.

It also advises customers that they can use a one time passcode, sent by text message, to authorise an online card purchase if they’re having problems with their app.

We’re really sorry if you’re impacted by a disruption to Online and Mobile Banking right now. If you’re not able to authorise an online card purchase via the app, you can opt for a one time passcode via SMS. We’ll share updates here.

— HSBC UK (@HSBC_UK) November 24, 2023

HSBC’s mobile banking app is now suggesting that a ‘system upgrade’ is taking place:

Black Friday doesn’t seem like the ideal time to schedule an update…

Of course HSBC decide to do their online banking upgrade right in the middle of Black Friday, so I can’t check whether I have enough money for the offer I want because both mobile and PC banking are down 🙄🙄🙄

— Catherine Dunn ♠️🖤 (@CatherineDunn8) November 24, 2023

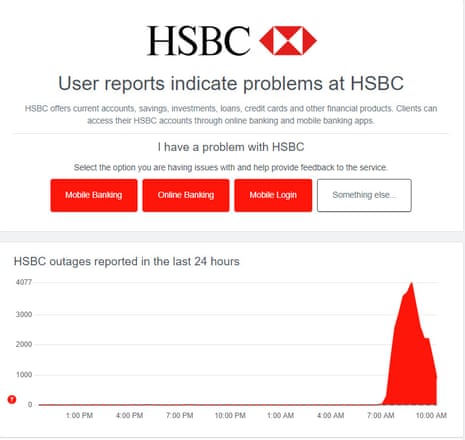

Downdetector, a website that tracks online outages, shows that reports of problems at HSBC started climbing around 7am this morning.

Here’s more reaction from HSBC customers to today’s technical outage:

Still having issues @hsbc, got to move some money so I can buy some Black Friday purchases (that I don’t need) Maybe it’s a sign!

— Sarah Leedham (@CarpeDiem123) November 24, 2023

HSBC @HSBC_UK online banking really decided to go down during Black Friday x payday.

Guess I’ll just save the money 😆

— Jennever Pelaez (@jenndpelaez) November 24, 2023

HSBC UK has apologised to customers and is working to restore its mobile and online banking service, including the authorising of online card purchases via the app, PA Media says.

HSBC hit by mobile and online banking problems

HSBC UK customers hoping to take advantage of Black Friday have been hit by technical problems with their banking services.

HSBC says it is investigating the problems as “as a matter of urgency”, as customers report problems using its app or accessing online banking.

In a post on X (formerly Twitter), HSBC says:

We understand some customers are having trouble accessing banking services as usual right now.

“We’re investigating this as a matter of urgency and will share an update as soon as possible.”

We understand some customers are having trouble accessing banking services as usual right now.

We’re investigating this as a matter of urgency and will share an update as soon as possible.

— HSBC UK (@HSBC_UK) November 24, 2023

HSBC’s status page says “some customers are currently experiencing issues logging on to online and mobile banking”, adding that “We are working hard to fix this”.

The technical problems could make it harder for people to transfer money between accounts to pay bills, or to fund Black Friday spending.

Fantastic for a global bank with no branches because online is so good, it’s payday, bills are going out but I can’t transfer my wage to pay them. You gonna pay everyone’s overdraft and late payment charges?

— Trisha (@trishanna81) November 24, 2023

Nationwide: Early Black Friday spending higher than last year

Black Friday in the UK has got off to a brisk start, according to new payments data.

Nationwide reports that by 9am, its customers had made 1.49 million transactions – 15% more than a typical Friday.

That’s also 9% higher than on Black Friday 2022, they say.

Mark Nalder, Director of Payment Strategy at Nationwide Building Society, says bargain hunters are already out in force, adding:

“The number of purchases made by 9am is already nine per cent higher than the same period last year and suggests that this year’s Black Friday is going to be the busiest one ever.

BoE chief economist: can’t ‘declare victory’ in battle against inflation

The Bank of England’s chief economist has declared that the BoE can’t relent in its battle against high inflation just because there are signs of weakening economic activity.

In an interview with the Financial Times, Huw Pill said the BoE’s Monetary Policy Committee cannot “declare victory and move on” now that inflation has dropped to 4.6% (which is still double its target).

Pill explained:

There’s slower growth in activity and employment as we’ve discussed. But because I think that is more supply-driven rather than demand-driven, the weakening of activity is not as associated with easing of inflationary pressures.”

This is the latest in a flurry of comments from BoE officials, which prompted Harriett Baldwin MP to accuse them of a “confusing running commentary” about interest rate policy.

Pill himself caused a stir earlier this month when he said market expectations of a rate cut next summer were “not totally unreasonable”.

BoE governor Andrew Bailey then tried to squash such talk, saying it was “far too early” to propose rate cuts.

Back in Germany, business sentiment has picked up, despite the economy teetering near a technical recession.

German business morale improved for the third month in a row in November, though by slightly less than expected, the latest business climate index from the IFO institute shows.

The index rose to 87.3, up from 86.9, with measure of the current business situation and economic expectations both improving a little.