Mars to buy Hotel Chocolat; ‘too early’ to consider UK interest rate cuts; US jobless claims rise – business live | Business

Introduction: Mars to buy Hotel Chocolat in £534m deal

Good morning, and welcome to our rolling coverage of business, the financial markets and the world economy.

UK chocolatier Hotel Chocolat has agreed to be taken over by food giant Mars in a £534m deal.

The takeover, announced to the stock market this morning, will help Hotel Chocolat expand internationally, the companies say.

And Mars is paying a steep premium to get its prize. It will pay 375p per Hotel Chocolat share, a hefty 170% premium to last night’s closing price of 139p.

Mars, which employs around 10,000 people in the UK, says the deal will bring a “much-loved brand into its portfolio” and deepen its relationships with consumers.

It adds:

The UK has been an important market for Mars, and it expects this to be complemented by the acquisition of Hotel Chocolat, with its distinctive capabilities in product development, luxury gifting and immersive brand experiences.

Hotel Chocolat’s directors say the offer is fair and reasonable, and are recommending shareholders back it (the directors hold about 54% of the stock).

Angus Thirlwell, chief executive officer of Hotel Chocolat, argues that teaming up with Mars makes sense for his company.

Thirlwell says:

We know our brand resonates with consumers overseas, but operational supply chain challenges have held us back. By partnering with Mars, we can grow our international presence much more quickly using their skills, expertise and capabilities.

The pillars on which we have built the Hotel Chocolat brand – originality, authenticity and ethical trading, is precisely what brought Hotel Chocolat and Mars together and our intention is to strengthen and invest behind these. I’m excited about the future of the business and in Mars we have found an excellent long-term steward of the Hotel Chocolat brand and everything we stand for.”

The agenda

-

9.30am BST: Latest realtime economic data on UK economy

-

1.30pm BST: US weekly jobless figures

-

2.15pm BST: US industrial production stats for October

-

3.45pm BST: Bank of England deputy governor Dave Ramsden speaks at the 7th Annual Conference of the European Systemic Risk Board ‘Financial stability challenges ahead: emerging risks and regulation’

Key events

US jobless claims rise

Just in: More Americans filed new claims for unemployment support last week, which may indicate a weakening jobs market.

There were 231,000 ‘initial claims’ for jobless support filed in the week to November 11, an increase of 13,000 from the previous seven days.

Initial jobless claims have been extremely low in recent years, so this may be a sign that the labor market is normalising.

The number of ‘continuing claims’ (people claiming unemployment support for at least two weeks) has also risen, up 32,000 to 1,865,000 in the week to November 4th.

That’s the highest since November 2021.

Back in the UK, housebuilder Crest Nicholson has signalled it could start cutting jobs soon as a slowdown in the construction sector hit its business.

The company said that it would “align headcount” in its divisions to their “expected level of output” in the next financial year.

The announcement follows a trading update in August which warned that Crest would have to start reducing its overhead costs.

Chief executive Peter Truscott said:

“Given the challenging trading backdrop we have experienced this year, the group has acted decisively in streamlining its operations to align our cost base with the operating environment.

“These are difficult decisions to take but will ensure the group is well positioned to recover strongly as more supportive market conditions return.

“I would like to thank all Crest Nicholson colleagues for their efforts this year and their professionalism in dealing with the changes we have made.”

Rivals such as Persimmon, Taylor Wimpey, and Bellway have all cut jobs this year too.

Walmart warns consume health is weakening

Over in the US, shopping giant Walmart has warned that consumer spending has weakened this autumn.

Shares in Walmart have dropped over 5% in pre-market trading, after it struck a cautious tone with its outlook after reporting financial results today.

In an interview with CNBC, chief financial officer John David Rainey said consumers are “leaning heavily” into major promotions as they watch their spending and search for deals.

Customers are holding out for lower prices, meaning Walmart has seen a drop in purchases before and after a sales event.

“Our events have been strong,” Rainey said, adding:

“We’ve been pleased with those. Halloween was good overall. But in the in the last couple of weeks of October, there were certainly some trends in the business that made us pause and kind of rethink the health of the consumer.”

Data yesterday showed a small drop in US retail spending in October.

Young’s to buy rival City Pub Group for £162m

In another takeover deal today, Young’s has agreed a £162m deal to buy London-based rival City Pub Group.

The move will bring a further 50 pubs into the Young’s business, taking its total estate to 279 pubs and bolstering its position as one of the biggest operators in London and the South East.

It comes against a challenging backdrop for pubs and the wider hospitality sector, amid pressure from higher borrowing costs and tighter customer budgets.

Young’s has said it will seek to benefit from “synergies” as part of the deal, particularly linked to overlapping jobs across the two firms.

Pound hits six-month low against euro

In the currency markets, the pound has hit its lowest level against the euro since May, as traders anticipate cuts in UK interest rates.

Despite Megan Greene’s insistance that it’s too early to consider cuts, sterling is down 0.3% against the euro today at €1.142.

The pound earlier fell as low as €1.1396, its weakest level since May 4th.

That highlights that yesterday’s drop in UK inflation, to 4.6% from 6.7%, has helped cement expectations that rates have peaked.

Jim Reid, strategist at Deutsche Bank, says the inflation report “saw investors grow in confidence that the Bank of England was finished hiking rates, with only a 11% likelihood of a further hike now priced in”.

The fact Mars is willing to pay a 170% premium for Hotel Chocolat’s shares is remarkable on two accounts, says AJ Bell investment director Russ Mould:

First, bid premiums are typically in the 25% to 50% range so Mars paying so much more would suggest it has taken a long-term view of what the business is worth.

Second, it suggests that Mars has spotted an opportunity and there is no way it wants to waste time with a low-ball bid. This looks like going in with its best offer with the hope of wrapping up the transaction as quickly as possible.

“Mars doesn’t have to worry about sales of its eponymous chocolate bar, but it does have to think about the evolution of the business and tapping into parts of the market who are looking for a higher quality product.

Hotel Chocolat ticks the right boxes and while its international expansion strategy hasn’t gone to plan, perhaps Mars thinks it has the necessary skills to make a good job of turning the UK chocolatier into a global name. It is hard to imagine shareholders turning down such a generous offer.

Mr Kipling maker plans price cuts as cost inflation eases

Mr Kipling and Ambrosia maker Premier Foods has said it will start reducing prices across some of its products after seeing a drop in cost pressures.

Premier Foods told the City this morning that its imput cost inflation has slowed, meaning it can pass this onto consumers.

Alex Whitehouse, chief executive officer at Premier Foods, says:

“We know how challenging the past year has been for many consumers and so it’s good to see the rate of input cost inflation falling.

This has now given us the opportunity to lower promotional prices across a number of our major branded products such as Batchelors Super Noodles and Mr Kipling Slices.”

This means a cup of Super Noodles – a popular student snack – will cost less than a pound again, the Evening Standard says.

Food ingredients, and energy costs, surged after the invasion of Ukraine in March 2022. But global food prices have since fallen back to a two-year low.

Premier Foods has also reported a 17.7% increase in revenues in the first half of the financial year, to 30 September, with pre-tax profits up 38%.

Trading profits rose 19%, with profit margins in line with prior year, the company added.

Mars’s takeover of Hotel Chocolat is likely to add to concerns about an exodus from the London stock market, says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Streeter says:

The Mars owner clearly sees Hotel Chocolat as an appetising addition to its shelf of confectionery brands, providing an upmarket option to sit alongside Snickers, Twix, M&Ms and the ubiquitous Mars bar.

The price being paid is at a hefty premium to the share price at the close of trading yesterday but given the weakness of the pound would have helped fuel hunger for the acquisition. Hotel Chocolat has a loyal customer base of cocoa lovers, helped by its tasting club and its strategic locations across the travel network.

Although the company posted two profit warnings earlier this year, the recent update has been more encouraging, showing a turnaround bearing fruit, with stronger sales particularly at its new shops. International expansion however has proved super tricky for Hotel Chocolat, with its Japanese joint venture forced through insolvency.

The clout of the Mars operation, should help ensure Hotel Chocolat’s future ventures are far slicker, and the company clearly sees great opportunity for the brand’s expansion into other markets, particularly in the airport retail sector.’’

Although Hotel Chocolat’s shares are still up 160%, near to Mars’s offer, the wider stock market is more subdued.

Britain’s blue-chip FTSE 100 index is down 40 points, or 0.55%, at 7446 points, after three days of gains, while the FTSE 250 index of medium-sized companies is down 08.%.

Kyle Rodda, senior market analyst at Capital.com, says markets have been hit by US president Joe Biden calling Chinese president Xi Jinping a “dictator” at a press conference today.

Rodda explains:

Risk assets were already on the back foot in Asian trade. However, the comments gave the market an extra nudge in the bearish direction, as the tone of what had otherwise been a constructive visit to the US by the Chinese President soured. The White House hasn’t publicly retracted the comments or clarified yet. Whatever the outcome, it’s a stark reminder that geopolitical risks are never too far away from being a volatility driver in this market.

Futures are implying a soft open for the markets tonight, as Wall Street looks poised to take a breather following a ripping run through November. US jobless claims are released and expected to show a slight uptick in the number of Americans seeking unemployment benefits. At the same time, industrial production and the Philly Fed Manufacturing Index is tipped to decline.”

Mortgage lenders slashed more fixed rates to sub-5% this week

A string of UK lenders have cut their mortgage rates this week, as the financial markets have concluded that Bank of England interest rates are now at their peak.

Data provider Moneyfacts reports that Halifax, HSBC, Yorkshire Building Society, Virgin Money, Bank of Ireland UK and Bank of Ireland UK for Intermediaries have all revealed new sub-5% two-year fixed mortgages this week.

There are now 27 lenders offering a sub 5% fixed mortgage, Moneyfacts reports, up from 13 at the start of October.

At the start of November only Danske Bank was offering two-year fixed mortgages priced below 5%, with no lenders offering this at the start of October.

Rachel Springall, finance expert at Moneyfactscompare.co.uk, says:

“It’s encouraging to see cheaper mortgages on the market for borrowers, particularly the return of two-year fixed mortgages priced below 5%. This is great news for those who do not want to commit to a longer-term fixed deal. Several large lenders have slashed fixed mortgage rates and there is much anticipation for more cuts in the coming weeks.

As we head ever closer to the year-end, lenders will be weighing up both the current competition and their own lending targets, so it’s a promising market for consumers looking for a new deal.

Expect light trims before Christmas followed by a tentative cut next year, but restyling rates won’t kick in till there is inner confidence in taming inflation. Expectation; post election https://t.co/kEfpkRIs51

— Emma Fildes (@emmafildes) November 16, 2023

Hotel Chocolat’s swoon into the hands of chocolate giant Mars comes seven years after it floated on the London stock market.

That float, at 148p per share, valued the company at £167m, with founders Angus Thirlwell and Peter Harris recieving £20m each in 2016.

At the time, Thirlwell insisted that “Anyone who knows me knows that I am not really motivated by money”.

He and Harris each still own 27% of the company, so will pick up another £144m each through the sale to Mars.

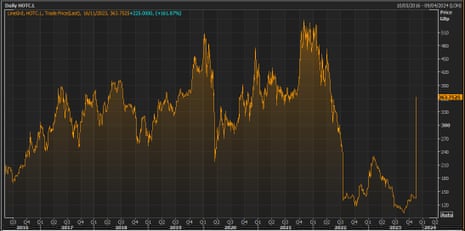

Although Mars is paying a chunky premium of 170% to last night’s share price, today’s takeover offer is still below the peak of Hotel Chocolat’s value in 2021 (when shares hit 540p, valuing the firm at £740m).

EY picks Janet Truncale as the first woman to lead a Big Four firm

In the accountancy world, EY has become the first Big Four firm to appoint a woman as chief executive.

Janet Truncale, currently the head of EY’s financial services business in the Americas, will replace Carmine Di Sibio, who is retiring in June.

Partners were informed of the move yesterday in an email, in which Di Sibio said:

“Truncale is an exceptional leader, with a strong foundation in serving clients across all EY’s businesses.”

Truncale’s appointment comes just months after EY scrapped its planned breakup, which included a plan for the company to spin off its consulting business and much of its tax practice into a stand-alone public company.

The FT says Truncale beat early favourites including the British partner Andy Baldwin, who helped craft the spin-off plan, and Jad Shimaly, who runs EY’s business in Canada.

Megan Greene then warned that global investors have not fully grasped the message that central bank interest rates may have to stay at restrictive levels for some time.

BoE policymaker Greene told Bloomberg TV that there had been structural changes in major economies over recent years that pointed to a need for higher interest rates.

She says:

“I think markets globally haven’t really clocked onto this.”

Investors are expecting several cuts to UK interest rates next year, bringing them down to 4.5% by the end of 2024, down from 5.25% today.