The Body Shop set to appoint administrators; UK hit by ‘significant long-run cost of Brexit’ – as it happened | Business

Introduction: The Body Shop is lining up administrators

Good morning and welcome to our rolling coverage of business, the financial markets and the world economy.

Thousands of jobs are at risk at The Body Shop, as the cosmetics retailer’s new owners line up administrators for its British arm.

The Body Shop could go into administration as early as this week, leading to store closures, having suffered disappointing trading over Christmas and in early January.

The retail chain, which has more than 200 shops, was bought by the pan-European private equity investor Aurelius last November.

Administrators at FRP Advisory are likely to be appointed as soon as this week to handle an insolvency process, Sky News reported on Saturday, citing sources who said they expected the closure of a significant number of the stores.

The Body Shop’s international businesses have already been sold to an unknown family office, according to Retail Week.

The Body Shop, known for its ethical trading ethos, dates back almost 50 years, as my colleaue Rob Davies explains:

Roddick, an environmental campaigner, activist and entrepreneur, founded the Body Shop in Brighton in 1976. The company remained under her ownership for three decades, until she sold it in 2006. Roddick died the following year.

By then, The Body Shop had become synonymous with its ethical positions, including a refusal to stock products tested on animals and a sourcing of ingredients from natural products that are traded ethically.

It looks set to be another interesting week ahead for financial markets with a good mix of central bank speakers and data coming into play as the week progresses. Asian trading sessions will experience a drop in liquidity with several markets enjoying the Lunar New Year…

— IC Markets Global (@IC_Markets) February 11, 2024

…before the Bank of England’s Governor Andrew Bailey speaks at the UK’s premier university – Loughborough.

— IC Markets Global (@IC_Markets) February 11, 2024

The agenda

-

10am GMT: European Commission winter forecasts -

Noon GMT: India’s industrial production data for December & inflation for January

-

1pm GMT: Russian balance of trade for December

-

6pm GMT: Bank of England governor Andrew Bailey gives lecture at Loughborough University

Key events

Closing post

Time for a recap…

The new owners of The Body Shop are expected to call in administrators for its UK business soon, only weeks after buying it.

The retailer, which has about 200 outlets in Britain, is poised to appoint administrators at FRP Advisory, following weak trading over Christmas and January.

The move is likely to result in lost jobs and shop closures, although analysts also say The Body Shop should continue in some form afterwards.

Customers have been reminiscing about favourite products such as body butter, bath pearls and white musk perfume.

The UK’s real GDP has underperformed by about 5% following Brexit, new analysis from Goldman Sachs shows.

Goldman says:

First, we show that UK goods trade has underperformed other advanced economies by around 15% since the referendum.

Second, business investment has been weak since 2016, falling notably short of the pre-referendum trend.

Third, immigration from the EU has dropped sharply but non-EU immigration has risen significantly, although the recent increase has been skewed towards students with lower participation rates.

In the global economy, the head of the IMF has said she is very confident that “the world economy is now poised” for a soft landing.

Mobile phone network operator Three has been hit by technical problems that have affected thousands of customers.

More than 11 million working-age people in Britain don’t have basic “rainy day” savings of at least £1,000, a new report has found.

Workers in the UK can expect less generous salary settlements this year, as employers rein in hiring plans, according to a report from the professional body for human resources.

Delivery drivers for food-ordering platforms including Deliveroo and Uber Eats are staging a Valentine’s Day strike to demand better pay and conditions.

The UK government has said it is working on making sites available for new nuclear power stations, amid reported talks with the owner of the Wylfa facility in north Wales.

Joe Biden has criticised food companies for alleged “shrinkflation”, making products smaller while keeping prices the same, in a video to mark the Super Bowl.

Two American oil and gas companies have said they will merge in a $26bn (£21bn) deal, the latest in a wave of acquisitions designed to buy up the best land for drilling.

Adnams has confirmed it has called in advisers to explore options to raise funds as the Suffolk-based brewer aims to secure its financial future.

We want to hear from people about their favourite things about The Body Shop, as it moves towards appointing administrators

‘Worried’ Body Shop workers in Inverness and Aberdeen said last weekend that they had not been told what was happening to the chain.

A source told The Press and Journal:

“Shop staff heard the news about The Body Shop from other colleagues.

“We had no idea what is happening with the closure of shops.

“It is a real shame that no one has talked to the staff. There are hardworking dedicated workers in our stores, and we deserve to know before everyone else.”

She added:

“It is a very worrying time. No, staff have not been told anything.”

Another said:

“Everything is speculation at the moment, nothing is closing at the moment.”

UK mobile operator Three suffers network outage

Mobile phone network operator Three has been hit by technical problems that have affected thousands of customers.

Website Downdetector shows that around 12,000 people reported an outage at Three around 11.30am this morning; some have reported no internet connection or mobile signal.

This is Three’s third outage in four days, according to website ISPReview, following problems on Friday and Saturday.

Three has confirmed there has been “an issue”, and says services are now recovering.

Following an issue with our network that started earlier, services are now recovering.

We know a number of our customers are still waiting on their service to be restored, and our engineers are working to fully fix it (1/2)— Three UK (@ThreeUK) February 12, 2024

Over in New York, the US stock market has opened cautiously at the start of a data-heavy week.

The Dow Jones industrial average of major US stocks is down 17 points, or 0.05%, at 38,654.

After hitting a succession of record highs in recent sessions, the S&P 500 index is up 15 points at 5,028.

Traders may be lacking energy after the drama of the Super Bowl last night. But there’s also some anxiety ahead of the latest US inflation data, due tomorrow, which is expected to show a slowdown in price rises.

The UK’s services trade has performed better than the goods trade, Goldman adds, which is “confounding expectations for a significant decline after Brexit”.

They add:

Indeed, services exporters are far less likely to report additional costs resulting from Brexit. Services account for over 40% of the UK’s total trade volumes, more than in the other G7 economies, and so this provides an offset to lower goods trade volumes.

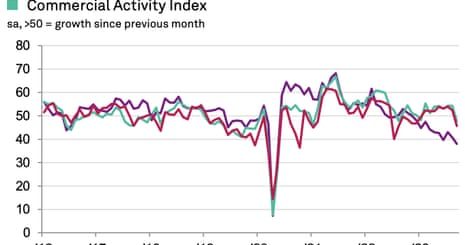

This chart from Goldman’s anaysis shows how UK goods trade has been weaker than the G7 average since Brexit, as well as lagging the “Doppelgänger” they created to simulate a UK which stayed within the EU.

But it’s hard to really see what’s going on, given the impact that Covid-19 and the Ukraine war have both had on global trade.

Goldman agrees there are still “several open questions” regarding the trade effects, adding:

While the UK’s goods exports to the EU have been weak, goods exports to the rest of the world have fared similarly poorly. However, this is not necessarily evidence against weakness in goods trade being driven by Brexit.

As other studies have noted, the UK’s goods trade with the rest of the world may also have suffered from spillover effects related to changing supply chains.

Goldman Sachs conclude their analysis by looking at how Brexit and its economic repercussions might evolve.

They say:

The UK is in the process of negotiating a number of non-EU trade deals. While new trade agreements could, in principle, help mitigate some of the long-term costs of Brexit, many of the post-Brexit agreements simply rolled over existing agreements and estimates suggest that the benefit from new trade deals is likely to be small. For example, the government estimates that a free trade arrangement with Australia would boost UK GDP by 0.08%. Moreover, the timeline for major new trade deals—including with the US and India—remains unclear.

The direction of UK/EU trading relations is therefore likely to be quantitatively more important. While we see a number of areas for potential closer cooperation, the direction will depend importantly on the next government’s plans and priorities. Comments by Prime Minister Sunak suggest that major changes under a new Conservative government would be unlikely. Labour leader Starmer has pledged to use the 2025 review of the TCA to push for closer relations. Starmer has flagged the potential for incremental steps in a number of areas—including a veterinary agreement, plus closer ties in professional and financial services—but ruled out rejoining the customs union, or the single market.

UK economy suffering a “significant long-run output cost of Brexit”, says Goldman Sachs

The UK economy has suffered a “significant long-run output cost” from Brexit, new analysis from Goldman Sachs shows.

Goldman have looked into the economic costs of Brexit, both structural and cyclical, and found that UK real GDP has fallen short of similar countries by about 5% since the 2016 referendum.

To find this, they conducted a “Doppelgänger” analysis – using statistical techniques to find the best combination of other countries that match the path of UK real GDP before the referendum and using this same combination to project what might have happened thereafter, had the UK remained in the EU.

The problem with this Doppelgänger approach is that the UK economy may have been worse hit by the pandemic and the energy crisis than other countries.

But still, Goldman say the UK has suffered from higher trade costs, lower business investment, and a fall in immigration from the EU.

They say:

First, we show that UK goods trade has underperformed other advanced economies by around 15% since the referendum.

Second, business investment has been weak since 2016, falling notably short of the pre-referendum trend.

Third, immigration from the EU has dropped sharply but non-EU immigration has risen significantly, although the recent increase has been skewed towards students with lower participation rates.

Goldman adds that while overall immigration has been higher than expected – it hit a record in 2022 – there has been an increase in overseas students coming to study, rather than EU immigrants coming to work.

They add:

Taken together, the evidence points to a significant long-run output cost of Brexit, broadly consistent with the range predicted by prior studies.

Suffolk brewery Adnams looking to raise new funds

UK brewery group Adnams are looking to raise fresh funding as it tries to grow its business.

Adnams, which was founded in 1872 and is based in Southwold, Suffolk, told the City this lunchtime:

Following media speculation, the Board of Directors of Adnams plc (the “Company”) wishes to clarify that the Company has instructed advisors to explore a range of options to fund the Company’s future growth plans.

As a business of more than 150 years, and ever mindful of the challenges faced by the hospitality and brewing industries in recent times, the Company is continually proactive in seeking ways to ensure that the business is even more resilient for the years to come.

Sky News reported last weekend that potential options are likely to include an injection of private capital from a high net worth investor or family office.

Chris Brook-Carter, chief executive at the Retail Trust, the retail industry charity, says workers across the sector have been suffering:

“We’re very sorry to hear the news about the Body Shop and the impact this could have on the thousands of people who currently work there.

“This kind of uncertainty only adds to the pressure many people in retail are already facing, which is being borne out by the numbers of workers and retailers reaching out to the Retail Trust for help right now.

“In the last year alone, we’ve received more than 11,000 calls to our wellbeing helpline, given out more than £600,000 in financial aid and worked with more than 200 retailers to help improve the wellbeing of their staff, as retail workers everywhere continue to be impacted by everything from job losses and the high cost-of-living to increased levels of abuse from members of the public.

“We know there will be many people out there with worries and concerns so we’d encourage anyone who thinks we can help to get in touch with the Retail Trust on 0808 801 0808.”

Diamondback Energy buys Endeavor Energy Resources in $26bn deal

Newsflash: A major deal to create a $50bn US energy giant has just been announced.

Diamondback Energy, the Texas-based independent oil and natural gas company, is buying rival Endeavor Energy Resources for $26bn of cash and share.

Endeavor produces oil and gas from the Permian Basin, the largest US oil field, located in southeastern New Mexico and much of West Texas.

Diamondback, which is worth $27bn, has fought off competition from other interest parties including ConocoPhillips.

Endeavor was created by Texas oil engineer Autry Stephens, and is one of the largest private oil producers in the U.S., generating some 311,100 barrels of oil equivalent per day.

To lower his production costs, Stephens created and used his own fracking, construction, trucking and other services companies, Reuters explains (more here).

Biggest drop in average two-year fixed mortgage rate since 2022

The average two-year fixed mortgage rate available to UK borrowers has fallen at the fastest monthly rate since the end of 2022, new data shows.

Moneyfacts reports that the average two-year fixed mortgage rate fell “significantly” in January, by 0.37%, its biggest monthly fall since December 2022.

This lowered the average two-year fixed mortgate rate down to 5.56%, down from 5.93% at the start of January.

Moneyfacts says:

-

Average mortgage rates on the overall two- and five-year fixed rate deals fell for a sixth consecutive month.

-

The overall average two- and five-year fixed rates fell between the start of January and the start of February, to 5.56% and 5.18% respectively. The average two-year fixed rate stands 0.38% higher than the average five-year equivalent.

-

The average ‘revert to’ rate or Standard Variable Rate (SVR) fell slightly by 0.01%, to 8.17%.

-

The average two-year tracker variable mortgage remained at 6.15%.

-

Product choice overall fell month-on-month, for the first time since July 2023, to 5,787 options.

-

The availability of deals at the 95% loan-to-value tier (274) has increased to the highest level since September 2022 (274).

-

The average shelf-life of a mortgage product rose to 28 days, the highest figure since February 2023 (28 days).

Those still tracking or on SVRates see little change but overall Avg mortgage rates on 2 & 5y fixed rate deals fall for the 6th consecutive month to 5.56% & 5.18% respectively between Jan-Feb.

The avg 2y fixed rate stands 0.38% higher than the avg 5y equiv @Moneyfacts_couk pic.twitter.com/nOtddcmyH7— Emma Fildes (@emmafildes) February 12, 2024

This drop came despite the money markets trimming their forecasts for how many times the Bank of England will cut interest rates this year – to three, down from six expected at the end of last year.

Rachel Springall, finance expert at Moneyfacts, said:

“Borrowers searching for a new mortgage deal may be delighted to know fixed mortgage rates continued their downward trend, with the average two-year fixed rate dropping by its biggest margin (0.37%) since December 2022.

Those borrowers who have waited patiently in recent months to re-finance, or indeed are preparing for when their mortgage deal expires, would be wise to review rates, as lenders are closely monitoring the volatile swap rate market, which tends to influence fixed rate pricing.

There have been big expectations for fixed rates to fall further, and whether now is the right time to refinance will come down to an individual’s circumstances. Lenders are in constant review of their ranges, and it is likely rates will fluctuate in the coming weeks due to the noises surrounding future rate expectations.

The head of the IMF is also concerned a prolonged war between Israel and Hamas would impact global economies, causing further disruption to Red Sea shipping.

Kristalina Georgieva told today’s World Governments Summit in Dubai:

“I fear most a longevity of the conflict because (if) it goes on and on the risk of spillovers go up. Right now we see a risk of spillover from the Suez Canal.”

“But if there are other unintended consequences in terms of where the fighting goes, then it can become much more problematic for the world as a whole.”

IMF chief “very confident” world economy will achieve soft landing

The head of the International Monetary Fund has declared she is now “very confident” the world economy will see a soft landing.

IMF managing director Kristalina Georgieva told the World Government Summit in Dubai that:

“We are very confident that the world economy is now poised for this soft landing we have been dreaming for.”

Georgieva also predicted that interest rates would start coming down from the middle of this year in major economies, such as the US:

“I expect to see by mid year interest rates going in the direction inflation has been going on for the last year”.

Georgieva also spoke about the possibilities, and risks of artificial intelligence.

She warned it would be devastating if AI led to more inequality, either within countries or between countries, and added that there’s a risk that AI is used to create a “parallel universe” of lies and misinformation.

Last month, an IMF report predicted that AI will affect 40% of jobs around the world.

Administration is likely to results in “significant” job losses and store closures at The Body Shop, fears Gavin Kramer, senior associate at Collyer Bristow.

“British brick and mortar retailers have been facing formidable challenges for years, and even post-Covid, the fate of well-known chains like Wilko shows that long-standing brands are still vulnerable to changing consumer habits and squeezed household spending.

Given its positive reputation, and the strong demand for ethically sourced consumer products, The Body Shop will hopefully, after entering administration, be able to find a buyer for at least some elements of the business, like its most profitable stores or its online retail business.

Administration is an insolvency process which protects a company from legal action by its creditors while efforts are made to save either the company or, through a sale, the company’s business. However, it’s an unfortunate reality that a business in this situation can seldom avoid significant job losses and store closures.”

Analyst: Administration would be “disappointing development” for one-time trailblazer

If The Body Shop appoints administrators it will prompt fresh concerns about the health of the British high street, says Susannah Streeter, head of money and markets at Hargreaves Lansdown.

Administration will give its owner, Aurelius, the breathing space to restructure and close highly underperforming stores and refocus attention on e-commerce sales – making it likely that some shops will shut for good.

Streeter says:

While the plug will not be pulled on a brand that has lasted almost 50 years, it does still mark a disappointing development for what was a trailblazing venture.

In the 1980s, the Body Shop was the place to go for young shoppers to splash out on fresh scented bubbles and beauty ranges, with a deep environmental conscience and a focus on social justice and conserving nature.

But now stores like Lush hold the bigger pocket money draw for tweens and teens, lured in by fragrant bath bombs and innovative product ingredients. Rivals have stolen a march on what used to be the Body Shop’s unique eco-credentials.

The Body Shop’s sale to L’Oreal in 2006 was the start of a slow decline for the once unique bath and beauty store, Streeter adds:

Anita Roddick was a visionary, offering refills to cut down on plastic decades ago, but that policy was quietly shelved in the 90s to refocus on packaged gift baskets with refill stations only brought back a few years ago. It seems it was too little too late and the Body Shop brand has been struggling to stand out amid a crowded beauty market.