Pound hits $1.27 as Bank of England pushes back against rate cut predictions – business live | Business

Bank of England leaves rates on hold

Newsflash: The Bank of England has left UK interest rates ON HOLD at 5.25%.

This means borrowing cost are still at a 15-year high, as policymakers try to squeeze inflation out of the economy.

Details to follow….

Key events

Analysis: How long can Andrew Bailey hold line on interest rates?

Phillip Inman

The UK’s inflation problem is unique and cannot be likened to the US or the eurozone, the Bank of England argues in its latest health check of the UK economy today, my colleague Phillip Inman reports from the Bank.

In a message that signalled interest rates could increase again before they start falling, the Bank said there are considerable price pressures in the UK that are absent in most of the its main competitors.

And for that reason, while interest rates might fall next year in the US and the eurozone, the first rate cute in the UK is a long way down the track.

In his letter to Jeremy Hunt, the governor of the Bank, Andrew Bailey used tough language to explain why monetary policy will need to be “restrictive for an extended period of time”.

He described the main pressure on prices being generated by high wage demands, mostly in the services sector.

He said the UK inflation rate, far from tumbling, may increase in January, such is the influence of sustained wage increases in the services sector.

The central bank acknowledged that recent data has shown the labour market weakening and wages growth slowing. However, its interpretation of this trend is that far from showing signs of a dramatic decline, wages remain sticky and need to fall much further before interest rate cuts can be considered.

This outlook contrasts with the view of investors, who are betting Bailey and his colleagues will soon buckle to demands for lower rates.

Financial markets took their lead this morning from comments by Federal Reserve chair Jerome Powell that the course of interest rate policy was about to pivot away from increases to a series of cuts.

Stock markets soared after new forecasts from Federal Reserve officials pointed to 0.75 percentage points of cuts next year.

Bailey argues that zero growth in the UK next year and something close to zero in 2025 will be a sign of too much resilience. Interest rates will need to remain high.

In this view, the Bank almost stands alone. Telling the world it will ignore the global trend for reducing borrowing costs transforms what until now has been a gap between the Bank’s rhetoric and the financial markets into a chasm.

There will be analysts who say the Bank has lost control of the narrative before and looks like doing so again.

Right now, the financial markets are unconvinced by the Bank’s stance that a weakening economy is no reason to cut interest rates.

When the Fed has signalled it will be cutting soon in response to low prices growth and tumbling inflation in the eurozone will likely persuade the European Central Bank to do the same next year, how can Bailey hold out?

The rally in London’s stock market has lost some of its zip, after the Bank of England sounded more hawkish than investors had hoped.

Shares are still higher, with the FTSE 100 index up 113 points or +1.5% to 7661 point.

That puts the Footsie on track for its best day since October. Earlier this morning, when investors were cheered by the Federal Reserve’s dovish tone yesterday, it was on track for its best day this year.

Back in Frankfurt, Christine Lagarde has insisted that the ECB did not discuss cutting interest rates at all, at this month’s meeting.

There was no discussion, and no debate, on this issue at all, Lagarde insists.

And she insists there is “a whole plateau, a whole beach” where policymakers can hold interest rates, rather than raising or lowering.

She compares it to phase changes in physics, explaining that you don’t go from solid to gas without going through the liquid phase.

Video: Andrew Bailey pledges to do ‘what it takes’ to bring inflation down to 2%

Back in London, the Bank of England have released a video in which governor Andrew Bailey explains why rates were left on hold at 5.25% today.

Bailey points out that the Bank has raised interest rates five times this year, so it chose to leave borrowing unchanged “because previous increases in interest rates are working and inflation is moving in the right direction”.

He explains:

That’s supported by the conversations we have with businesses around the country about the pressures they face on their costs, and their pricing decisions.

But there is still more to do, Bailey insists, saying:

We need to get inflation all the way back to 2%, and we are likely to need to keep interest rates higher for a while longer to do that.

We’ve come a long way in the last 12 months, and will continue to do what it takes to get inflation all the way down to the 2% target.

Christine Lagarde in Covid-recovery mode

In Frankfurt, ECB president Christine Lagarde is holding a press conference now, where she’ll explain why eurozone interest rates have been left on hold today (see earlier post).

She starts by asking for the press pack’s indulgence, as she is in “Covid recovery mode”.

Sporting a natty scarf, and sounding a little weaker than usual, Lagarde says she didn’t want to miss today’s governing council meeting, or the press conference – but if she starts “coughing my life out”, vice-president Luis de Guindos will take over.

Lagarde promises she’s not contagious; it’s “just acute bronchitis”.

Proper ECB vibes with Lagarde announcing, in an uncharacteristically tepid voice, that she is recovering from Covid. See you in the new year basically,.

— Claus Vistesen (@ClausVistesen) December 14, 2023

Lagarde then reads out the prepared statement, in which she warns that the risks to growth are skewed to the downside, while upside risks to inflation include geopolitical tensions.

What UK’s interest rate freeze means for mortgage borrowers

Hilary Osborne

Mortgage borrowers will be able to breathe a sigh of relief after Thursday’s announcement that the Bank of England has decided to hold rates at 5.25% – but amid the good news was a hint that the cost of home loans may not fall much further.

The Bank’s decision to hold rates was no surprise to the money markets, which are anticipating cuts next year. The consensus is that the base rate will fall to 4% in the next 12 months, but before today’s announcement some economists suggested it could drop to as low as 3.75%.

However, for the second month running, three of the nine members of the Bank’s Monetary Policy Committee voted for an increase, and the central bank said that, if needed, it would take that action to fight inflation.

For borrowers, that could mean mortgages are almost as cheap as they are going to be in the short-term…..

More here:

Over in the US, the number of Americans filing new claims for unemployment benefit has dropped.

There were 202,000 initial claims filed last week, a drop of 19,000 from the previous week.

Tha indicates the US jobs market remains solid – good news for workers, but could that take pressure off the Federal Reserve to cut rates next year?

US initial jobless claims 202K vs 220K estimate

— CGTN Europe (@CGTNEurope) December 14, 2023

European Central Bank holds rates

Newsflash: interest rates have also been held across the eurozone.

The European Central Bank’s Governing Council has decided to keep its three key ECB interest rates unchanged.

It says that “while inflation has dropped in recent months, it is likely to pick up again temporarily in the near term”.

And the ECB is also sticking to its belief that rates are high enough to help bring down inflation, saying:

Based on its current assessment, the Governing Council considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal.

The Governing Council’s future decisions will ensure that its policy rates will be set at sufficiently restrictive levels for as long as necessary.

The ECB has also cut its inflation forecasts, as expected.

It predicts inflation will average 5.4% in 2023, before dropping to 2.7% in 2024, 2.1% in 2025 and 1.9% in 2026.

ECB Will Set Interest Rates At Sufficiently Restrictive Levels

– Sees 2023 Inflation At 5.4%; Prior Forecast 5.6%

– Sees 2024 Inflation At 2.7%; Prior Forecast 3.2%— LiveSquawk (@LiveSquawk) December 14, 2023

Today’s decision means the interest rate on the ECB’s main refinancing operations remain at 4.5%.

Its deposit facility, which determines the interest that commercial banks receive for depositing money with the central bank overnight, remains at a record high of 4%.

The marginal lending facility – charged by the ECB when commercial banks ask for short-term loans – remains at 4.75%.

BoE’s Bailey says it’s too early to talk about rate cuts

Bank of England governor Andrew Bailey has insisted it is too soon to start thinking about cutting interest rates, despite encouraging progress on inflation.

Speaking to reporters shortly after the BoE left interest rates on hold at 5.25%, Bailey said:

“So my view at the moment is, it’s really too early to start speculating about cutting interest rates. We’ve got to see more progress.”

Bailey also said he could not guarantee that borrowing costs had peaked, saying:

“I’m encouraged by the progress we’ve seen, don’t get me wrong, I’m very encouraged by the progress we’ve seen.

But it’s too early to start speculating that we’ll be cutting soon.”

The Treasury have issued a response to Bank of England interest rate vote, which appears to endorse the decision not to lower borrowing costs today.

A HM Treasury spokesperson said:

“We have turned a corner in our fight against inflation and real wages are rising, but we must keep driving inflation out of the economy to reach our 2% target.

“By cutting taxes for hard working people and businesses, and helping people into work, we are forecast to deliver the largest boost to potential GDP on record.”

Hawkish BoE: What the experts say

Several City experts are explaining that the Bank of England is pushing back against market expectations for early rate cuts in 2024.

Dean Turner, chief Eurozone and UK Economist at UBS Global Wealth Management, predicts the first UK rate cut will come by next May, despite the hawkish words from the BoE today.

Turner says:

‘As expected, the BoE left interest rates unchanged and delivered the news with a hawkish message that inflation risks remain to the upside. Markets have moved a long way in recent weeks, bringing forward expectations for the timing of the next rate cut so some push-back was expected.

In our view, the hawkish tone from the Bank doesn’t square with fading inflation, a cooling labour market, and lacklustre growth. Thus, we continue to expect the BoE to cut rates next year as soon as the May meeting.

The pound rose following the announcement. In our view, the period of sterling strength has likely run its course and we would look to sell the upside against the US dollar from these levels.

Hetal Mehta, head of economic research at St. James’s Place, said:

“The Bank of England’s decision today to maintain a hawkish message sets it markedly apart from the Fed.

Underlying inflation is still uncomfortably high and the recent pricing of multiple rate cuts from early next year was clearly an easing of financial conditions that the BoE felt the need to push back against. The fall in wage inflation so far is not enough to be consistent with the 2% inflation target.”

And here’s Ed Hutchings, Head of Rates at Aviva Investors:

“Once again, the Bank of England kept rates at 5.25%, with no change to the 6-3 voting pattern, and similar language used to the last meeting in early November.

Going into the meeting and after the dovish Fed the day before, the market was pricing close to 1.25% of cuts in 2024. This is somewhat excessive, and we now would expect some of the size and speed of these cuts to be taken out.

he BoE seems keen to push back on markets getting carried away with cuts, which should largely be supportive for the currency, but elsewhere, gilt yields could well retrace some of their very recent excessive gains.

Medium-term however, with weaker growth and past hikes still yet to feed through, it’s getting clearer that this interest rate hiking cycle is close to, if not, done. This should in time ultimately be supportive for gilts.”

Is Andrew Bailey a bit more of a Grinch?

Is governor Andrew Bailey playing the role of the Grinch, in contrast to Fed chair Jerome Powell, who played Santa yesterday by hinting at US rate cuts in 2024?

Neil Wilson, analyst at Markets.com, suggests he may be.

He points to the market reaction, which shows investors are slightly trimming their forecasts for UK rate cuts in 2024:

Gilt yields firmer, sterling advancing further against the dollar – the BoE was a fair bit more hawkish than the Fed.

Markets trimmed bets on BoE rate cuts, down to 107bps of cuts by Dec ‘24 vs 115bps before, with the first cut now seen coming in June rather than May….rather like the Fed, only in the other direction.

But this could be a sign that the markets have misread the situation. With the UK economy shrinking in October, and the jobs market softening, there could be scope for the BoE to cut early next year.

Wilson adds:

Probably I would argue right now that the market is seeing the BoE as more hawkish than maybe it should, and the Fed likewise more dovish.

Pound hits $1.27 after Bank of England decision

The pound has surged over $1.27 against the US dollar, up almost a cent today.

That’s the highest level since 4 December, and close to the three-month high set at the end of August.

That highlight the difference in tone between the Bank of England this lunchtime, and the US Federal Reserve last night, although both central banks left borrowing costs on hold.

Yesterday, the Fed softened its language, with chair Jerome Powell telling reporters that the US benchmark rate was now “likely at or near its peak for this tightening cycle”.

Today, though, the BoE has said that the decision whether to increase or to maintain Bank Rate at this meeting was “again finely balanced” (see 12.12pm), with three of its nine policymakers wanting interest rates to be even higher (see 12.05pm).

As the Bank states:

The Committee continued to judge that monetary policy was likely to need to be restrictive for an extended period of time.

So while the Fed appeared to pivot last night, the Bank of England is holding a harder line (or at least trying to…).

The British dissent to match Fed’s pivot. Sterling above $1.27 after BoE delivered hawkish pause. Looks difficult how long BoE will extend the narrative. pic.twitter.com/B9vOlukPeG

— Arnob Biswas (@ArnobBiswas18) December 14, 2023

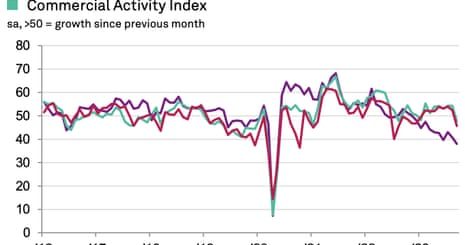

BoE: Inflationary pressures higher in UK than US or eurozone

Interestingly, the Bank of England also lays out a case for why the UK is facing a more inflationary environment than the eurozone or the US.

It says that underlying inflation (stripping out food and energy) is higher in Britain than across either the Atlantic or the Channel. Wage inflation is also running hotter here, it points out.

In the minutes released at noon today, the Bank says:

According to the flash estimate, annual euro-area headline HICP inflation had fallen to 2.4% in November. Energy and food prices had contributed to the decline, and core goods and services price inflation had also declined such that core inflation had fallen to 3.6%.

In the United States, headline CPI inflation had fallen to 3.1% in November, with energy price deflation contributing to the decline. Core CPI inflation had remained more stable in recent months, at 4.0%, as core services price inflation had eased more slowly.

Relative to both economies, core inflation had fallen back by less in the United Kingdom, to 5.7% in October, reflecting smaller declines so far in core goods price inflation and more elevated services price inflation.

To the extent that they were broadly comparable, measures of wage inflation were also considerably higher in the United Kingdom than elsewhere, even though there were signs of easing in all three economies.